8 Reasons to Offer Business Health Insurance

As an SME business owner, you may be wondering whether you should offer health insurance to your employees. Below are a few reasons why we think you should…

In a nutshell:

- Lower premiums – Group plans tend to be cheaper on average than individual plans.

- Tax incentives – Businesses can deduct the cost of premiums from their Corporation Tax.

- Improve hiring and recruiting – A robust benefits package can appeal to both new hires and current employees alike while setting businesses apart from competitors.

- Employee loyalty and retention – Offering group health insurance can help small businesses keep their top employees for the long term.

- Employee job satisfaction – Having happy employees who are content with their jobs and health benefits can make for happier employers.

- Healthier, more productive employees – When workers take less sick days and absences, they can retain focus and achieve more while having access to health care resources when needed.

- Cultivate a healthy company culture – Show your employees that their health is important to you by promoting a positive culture, encouraging wellness initiatives, and offering health coverage.

- Place health coverage within reach of employees – One reason employers offer group health insurance is to make medical coverage more accessible and affordable to their employees.

1. Access to lower monthly premiums

From a cost perspective, it may make sense to offer small business health insurance due to the reduced price of a group health plan. Generally, small business health insurance plans tend to have lower per-person costs on average, compared to health coverage in the individual market. This means that enrolling in a group health insurance plan can be more affordable than individual insurance not only for employees and their families, but for the business owner and his or her family as well.

Why are small business health insurance plans generally cheaper per person than individual plans? Group health insurance plans can cost less per person than an individual health insurance plan due the advantage of having a larger risk pool, or having risks spread out across more people.

2. Benefit from tax-efficient incentives

Another financial advantage of providing small business health insurance are the tax benefits to the employer that come with a group plan.

There are several ways that a group health plan can result in tax advantages for your business:

- Generally, employers can deduct 100 percent of the cost of monthly premiums they pay on qualifying group health plans from their Corporation Tax.

- Offering health insurance coverage to workers as part of their compensation package could also potentially mean that a business may benefit from reduced payroll taxes.

- Employers can usually deduct HSA contributions from their small business taxes.

While group plans already tend to be more affordable than individual plans, the tax advantages from offering small business health insurance can further help your company in providing this highly valued and sought-after employee benefit.

3. Improve your hiring and recruitment strategy

Deciding to offer small business health insurance can serve as an essential part of an effective hiring strategy, and can help a company stand out as an employer of choice.

Employee benefits may help small businesses stand out from competitors.

It may be challenging to attract quality workers without popular benefits like health insurance. As a result, offering group health insurance may also help small businesses stand out during the hiring process by beating offers from competitors who don’t offer employee benefits related to health care.

4.Encourage employee loyalty and retention

Employee loyalty is often an extremely important consideration for a small business, and offering health insurance may be an effective way to help retain your company’s quality workers.

Not only can a group health plan demonstrate that you are offering employees what they are worth; it can also encourage your workers to stay with your company in the long term.

5. Boost employee job satisfaction

Another great reason to offer small business health insurance is that it may play a significant role in helping maintain or increase employee job satisfaction. The importance of satisfied employees cannot be overstated.

How job satisfaction may benefit business owners

Happy employees can also mean happy employers. Workers who are generally satisfied with their jobs might express this in all sorts of relevant ways, including:

- More helpful, enthusiastic, and improved interactions with customers and clients.

- Greater likelihood of effective teamwork within a positive workplace environment.

- Inspiring employees to improve their skill set through further training and education.

In essence, better attitude from employees may result in better results for your bottom line.

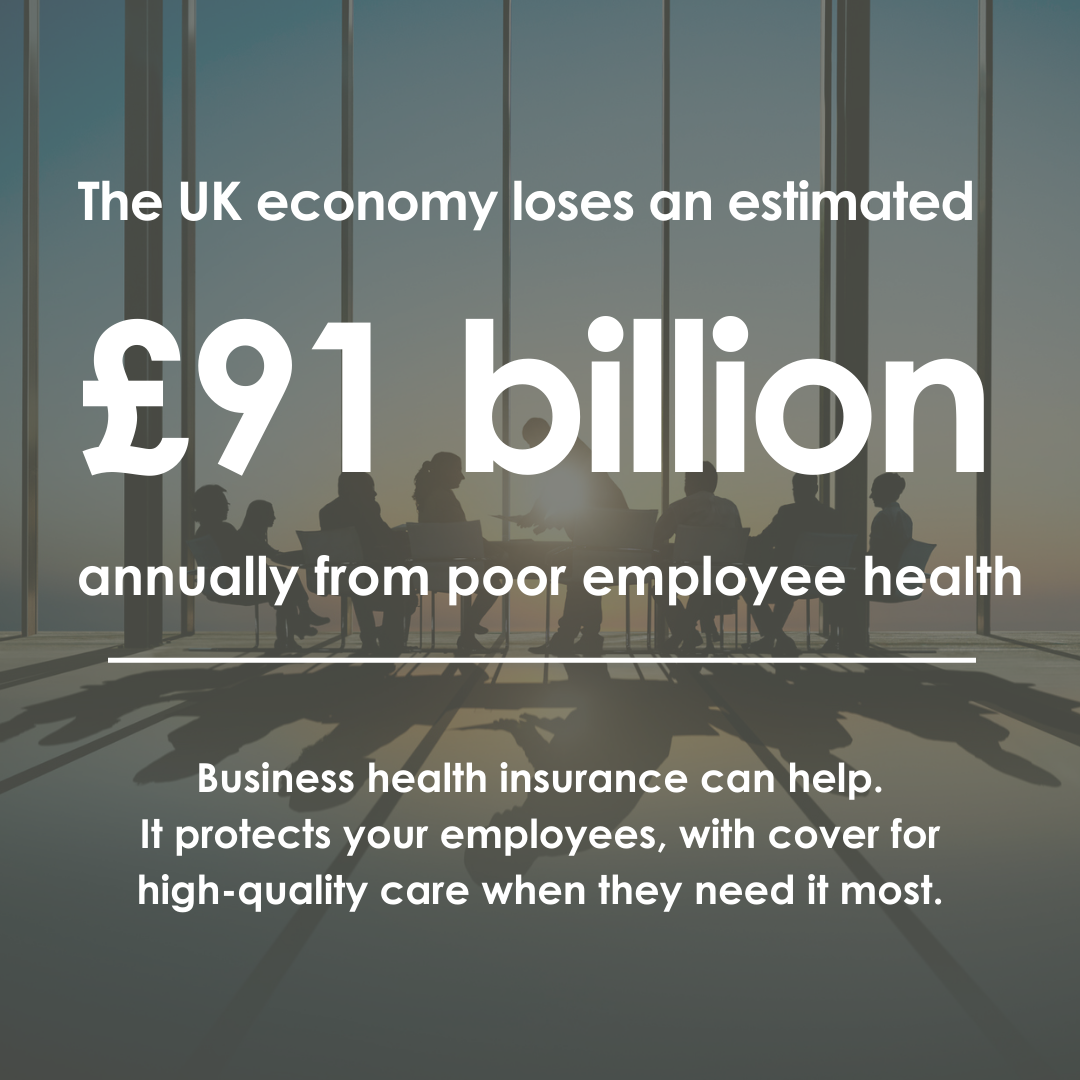

6. Healthier, more productive employees

When employees have group health insurance, they gain greater access to medical resources. Consequently, workers can rest assured that they can rely on their health care plan in case of illness or emergency. Many can place family members on the policy as well which offers greater peace of mind.

For a small business, providing employees with the peace of mind that comes from health insurance can mean less sick days and absences and more productive and focused workers.

Depending on your industry, it may be more cost-effective in the long run to pay for employees’ health insurance rather than having to deal with the lost time and productivity resulting from their absence from the workplace.

Additionally, providing group health insurance may contribute to a faster recovery time or return to work due to greater employee access to medical care and health resources.

Ultimately, having healthy employees can contribute to greater workforce productivity, which may help bolster the success and stability of your small business.

7.Cultivate a healthy company culture

Providing small business health insurance can show your employees that their health is important to you. By offering a group health plan as an employee benefit, you can demonstrate that you value your employees and view them as an asset to your organisation. This appreciation, in turn, could help to promote a positive and healthy company culture.

By investing in the well-being of employees, companies may be better able to encourage an environment of trust and a mindset of greater openness among their employees.

8. Help put health insurance within reach of employees

Some small business owners may decide to offer a group plan in order to help put access to health insurance within reach of their employees. Providing group health insurance for your workers may also help them feel more secure, both financially and professionally.

Get in touch for a quick, free quote